Andy Brown, KPMG

Andy Brown, KPMG Rob Brouwer, KPMG

Rob Brouwer, KPMG

Originally issued in May 2014 by the IASB and FASB, the new substantially converged revenue standard (IFRS 15/ASC Topic 606 Revenue from Contracts with Customers) provides a comprehensive framework replacing existing revenue guidance under both IFRS and U.S. GAAP.

The new standard will affect virtually all companies due to extensive new revenue disclosure requirements. The pattern of revenue recognition will also be significantly affected for some.

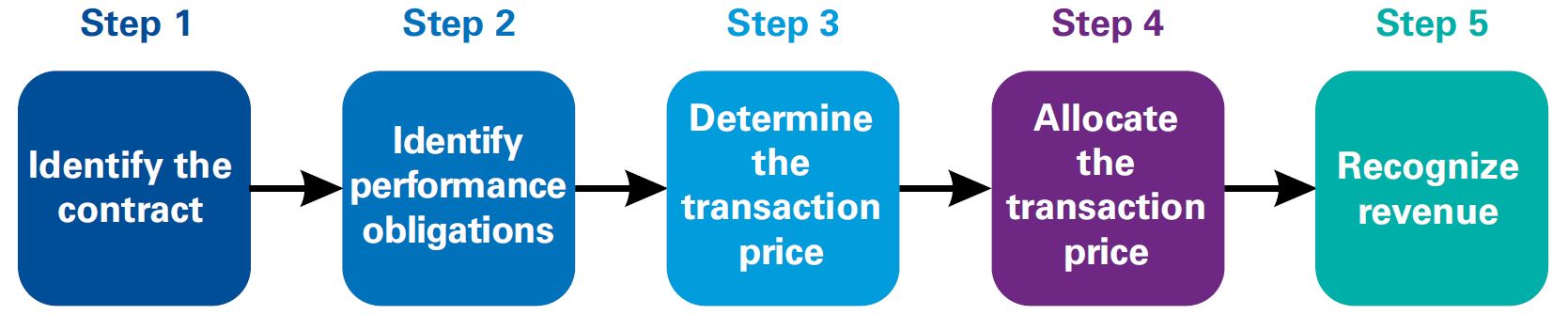

Under this new standard, companies will apply a five-step model to determine when to recognize revenue, and at what amount. The model specifies that revenue is recognized when or as a company transfers control of goods or services to a customer at the amount to which the company expects to be entitled. Depending on whether certain criteria are met, revenue is recognized either over time or at a particular point in time.

Companies that provide long-term service contracts or revenue arrangements with multiple elements may be particularly impacted by IFRS 15. Others may experience little change in the timing and amount of revenue recognized. However, arriving at this conclusion will require an understanding of the new model and an often complex analysis of its application to particular transactions.

Calendar year-end companies are required to implement the standard for their 2018 financial statements; however, depending on the transition option selected, this could require the preparation of comparative revenue information under IFRS 15 beginning January 1, 2017. That date is just around the corner and evidence suggests that too many companies are not as ready as they should be.

Implementation planning behind schedule

Clearly, once they have assessed the impact on their reported results and financial position, companies need to begin preparing their users for any significant changes. Given the importance of revenue information to the users of financial statements, one would expect that preparing for the implementation of IFRS 15 would be a priority. However, survey results indicate many companies have not finished their impact assessment and, in fact, some have not yet started. Almost 80% of U.S. public companies surveyed by KPMG U.S. earlier this year had not progressed beyond the assessment phase and over 60% acknowledged being behind schedule[i]. The U.S. Securities and Exchange Commission (SEC) staff has also noted that progress on implementation is lagging[ii].

Many companies completed a high-level impact assessment, which gave them some comfort about the perceived difficulty of implementation. However, many are experiencing significant challenges validating their high-level assessment. During their detailed assessments, many are finding a number of interpretative and judgment areas that require more time to address. A number of companies surveyed also identified competing priorities and constrained resources as the main reasons their implementation projects were behind schedule.

With year-end fast approaching, it is time to start thinking about communication to stakeholders and the disclosures companies will be required to make this year regarding implementation of IFRS 15.

Users want to know the impact

Revenue-related disclosure is among the most anticipated information users of financial statements look for, with good reason. In the near term, investors want to know if the new standard will impact the company’s key performance metrics; and whether the company is on top of the project or falling behind.

With investors requiring enough information to understand the impact of the new standard, regulators on both sides of the border have been setting expectations for upcoming disclosures in 2016 year-end financial statements.

The Ontario Securities Commission (OSC) released Staff Notice 52-723 from the Office of the Chief Accountant, referencing IFRS 15 implementation and its expectation for active oversight by audit committees[iii]. The OSC also expects increasingly detailed disclosure about the expected impact of the new standard, noting:

“It is reasonable to expect that quantitative information will be available and disclosed for the reporting date that coincides with the start of the comparative period that will be affected in a future financial report (for example, Q1 2017 for reporting issuers with a December 31 year-end that are adopting IFRS 15 on a full retrospective basis).”

Eliminating any doubt as to whether this issue was on the regulator’s agenda, the OSC noted that it intends “to monitor the quality and extent of disclosures” related to the implementation of the new standard, and reserves the right to seek clarification from reporting issuers when it sees an “inadequate level of transparency in this area.”

Similarly, at an Emerging Issues Task Force (EITF) meeting in September, SEC staff sent a reminder to the market, noting that when the effect of the new standard is not known or cannot reasonably be estimated, a registrant should consider additional qualitative disclosures to assist financial statement users in determining the significance of the impact of adopting the standard. The SEC staff also indicated a registrant should describe its progress in implementing the new standard and the significant implementation matters it still needs to address[iv].

Setting aside for a moment the expectations of regulators, the existing guidance of IAS 8 Accounting policies, changes in accounting estimates and errors, requires companies to make disclosures related to standards issued but not yet effective, disclosing either:

(i) a discussion of the impact of adopting a new standard; or

(ii) if the impact is not known or cannot reasonably be estimated, a statement to that effect.

Given the importance of revenue disclosures, investors and regulators may not be satisfied with the latter for much longer.

Investor relations professionals are well advised to keep connected to their finance teams to understand how the implementation of IFRS 15 is progressing and the impact on key performance metrics; they should be ready to discuss the communication plan for upcoming year-end financial statements.

[ii] James V. Schnurr, Chief Accountant, Office of the Chief Accountant of the SEC, stated in March 2016 that “implementation efforts appear to be lagging at many companies.”

[iv] September 22, 2016 Emerging Issues Task Force meeting

Andy Brown, CPA, CA is a Senior Manager, and Rob Brouwer, FCPA, CPA is Canadian Managing Partner, Clients and Markets, for KPMG LLP in Canada.