Kelly Freeman, PotashCorp.

Kelly Freeman, PotashCorp.

Is integrated reporting just another one of the latest buzzwords in the corporate reporting world? Some may believe this is the case, but that’s not our take at PotashCorp.

What is integrated reporting all about, and why should you consider it? If you’re interested in taking a step towards producing an Integrated Report, what do you need to do? Many corporate issuers are now beginning to consider what this evolving reporting method really means.

At PotashCorp, we have always placed high importance on external reporting. We believe that it engenders trust and credibility with our stakeholders. At the core of our company is the conviction that value is not only built through good financial performance, it requires a commitment to excel (and report) in all areas. This forms the cornerstone of PotashCorp’s external reporting, and our goal is to tell our story in a clear, consistent and comprehensive manner to all stakeholders.

One of PotashCorp’s core values is seeking continuous improvement, and we have adopted this approach in our reporting – with the goal of helping our stakeholders measure value creation through multiple lenses. For us, a move towards integrated reporting was a natural progression.

While 2012 was the first year that PotashCorp officially titled its Annual Report as an Integrated Report, we felt that our approach has always involved an integrated component. As we made the step towards integrated reporting, it did not necessarily change what we discussed across our reporting documents. Rather, we adopted a more focused approach to speaking about the items that impact value – from a company and stakeholder perspective – in a more integrated manner.

So what does integrated reporting really mean? The path begins with an assessment of the company’s business model and determining if it really encompasses a broader view of value. To put it simply, you can’t report what you don’t do. If your business strategies, goals and targets involve value creation beyond traditional financial considerations, it’s much easier to evolve from conventional financial reporting and/or conventional sustainability reporting, to integrated reporting.

Integrated reporting not only means that the issuer must consider a broader discussion; the issuer aids its stakeholders in better understanding how all aspects of its actions interact to impact value creation. This starts with defining value, from both the company’s and stakeholders’ perspectives. The difficulty is that value is not necessarily a dollar amount; one must consider the relationship between financial performance and areas such as safety, the environment and social impacts.

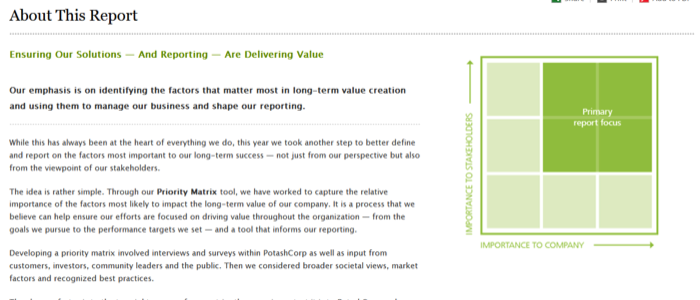

The company must have a ‘lens’ to determine where its interests align with those of stakeholders and where they may differ. This lens can then focus on items with the greatest potential to affect long-term value. While still in its infancy within our organization, critical to our success in determining the depth and breadth of our integrated reporting was the development of a ‘Priority Matrix’. This tool acts as our lens to ensure that we are considering both the integration and scope of what matters to our stakeholders and to the company. It is available at: http://www.potashcorp.com/annual_reports/2012/introduction/about-this-report/.

At PotashCorp, we believe that it is crucial to help stakeholders better understand what we do and how the company’s strategies and business model work together to create value for all of its key stakeholders. This is what forms the basis of PotashCorp’s Integrated Report. At its heart are five corporate goals designed to help foster sustainable value for all affected by our business. These goals are found at: http://www.potashcorp.com/annual_reports/2012/our-business/business-model/#value-building-factors.

The task is about more than telling the story – it’s about setting targets, measuring results and reporting on them – good or bad. A company needs to not only consider the best ways of measuring how stakeholder value is affected, but also commit to updating and discussing its performance in each area addressed. This might sound straightforward, but it’s important not to underestimate the support required for delivery. Measuring a company’s effectiveness in generating and distributing value for all stakeholders requires systems and performance metrics, as well as the ability to continually adapt and develop targets in a changing environment. Take a look at: http://www.potashcorp.com/annual_reports/2012/our-business/business-model/#value-building-factors.

Some organizations considering adopting integrated reporting are concerned that it is simply another layer in an already complex reporting world. Interestingly, that same concern led us down the integrated reporting path. One of our goals was to meet stakeholders’ need for information while simplifying our reporting. While we understand that different users have different needs, our view of success is that integrated reporting – if done right – can meet the needs of a broader range of stakeholders while creating less complexity and focusing on the things that really matter.

Take, for instance, a company that already produces an Annual Report and Sustainability Report and worries that the addition of an Integrated Report (in addition to the 10-K, Proxy Circular and any other regulatory publications) makes the reporting environment more complex. PotashCorp’s view is that a successful Integrated Report can blend the traditional Annual Report and Sustainability Report, providing a single document that reflects a common voice while still meeting regulatory requirements.

So what’s next? The key remains providing stakeholders with the tools to manage, sort, customize and mine the information (and discussion) they need. In PotashCorp’s view, true integration and usability is best delivered via the Web, and not just in an annual Integrated Report. This is where we see opportunity and where we are focused. We know we are not there yet, and many other leading adopters are similarly challenged. The future of this mechanism is still being defined and we are working hard to be part of this process.

At PotashCorp, we see opportunity in integrated reporting for both the company and its stakeholders, and we are excited about the road ahead.