IROs globally have perceived using Twitter, Facebook, or any other social media outlet as a gray area in terms of disclosure. Canadian companies got some clarification on March 9 regarding the dos and don’ts when the CSA issued Staff Notice 51-348. In the notice, the CSA reviewed the social media practices of 111 Canadian issuers and offered some advice on how companies should – and (equally importantly) should not – use Facebook, Twitter, LinkedIn, Instagram and their own web sites to keep investors informed.

A key takeaway, says Alison Trollope, Director, Communications and Investor Education for the Alberta Securities Commission, which contributed to the recently issued staff notice, is that “the only way to disclose material developments is via a news release filed on SEDAR.”

Matthew Merkley, Partner at the Toronto office of business law firm Blake, Cassels & Graydon, says that nothing in the CSA notice should make IROs shy away from social media. Instead, he explains, companies need to “exercise patience and make sure that they’re providing disclosure of information through more traditional channels first.”

The message is one that IROs seem to grasp – while welcoming the clarity that the CSA provided on how social media might best be used in some more nuanced situations. Discussing the notice, Megan Hjulfors, Supervisor of Investor Relations and Communications at ARC Resources Ltd., says: “We’re quite conservative and traditional so we wouldn’t have been using social media as our primary disclosure network anyway. A lot of what the CSA was saying was already best practice. So I don’t think it was a real game-changer.”

A Glimpse Into ‘Concerning Practices’

Carol Hansell, Senior Partner at Ontario-based law firm Hansell LLP, points out that the CSA’s notice is helpful, especially given that social media disclosure practices have evolved differently in the U.S. “The SEC has been more comfortable with using social media as a means of disseminating material information,” she says. Hansell explains that as long as investors understand which social media vehicles are used for dissemination, publicizing material, non-public information over Facebook or Twitter can be acceptable in the United States.

In Canada, however, a press release filed on SEDAR is the only form of sanctioned disclosure. The Canadian regulators, says Hansell, “don’t want people commenting on social media any more than you’d want them talking about a new product launch in a bar, an elevator or on a subway.”

Trollope notes that there are a number of critical points in the CSA staff notice, among them that if a non-GAAP measure is being communicated via social media, that measure must be quantitatively reconciled to its closest GAAP measure.

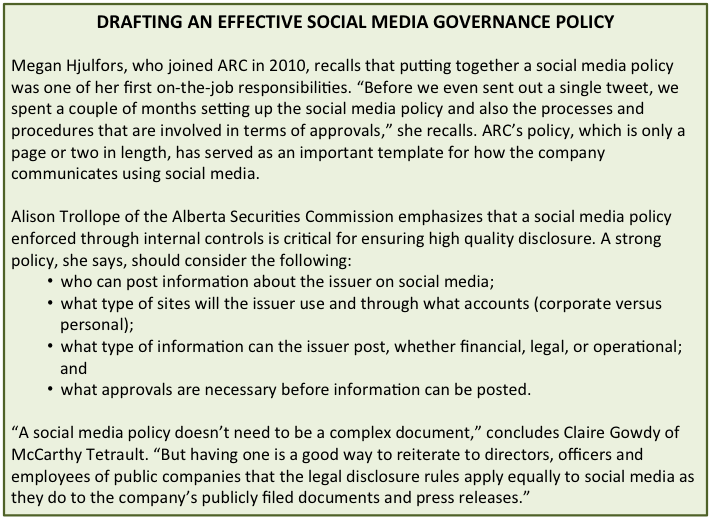

Another important point is that public companies should have social media governance policies in place, says Claire Gowdy, Associate in the Business Law group at Toronto-based McCarthy Tetrault. She notes that of the 111 TSX companies reviewed in the CSA’s social media report, only 23% had developed social media governance policies.

“Everyone’s using social media,” says Gowdy. “But not everyone realizes that the disclosure standards under securities law apply to such online activity. Directors, officers and employees at every level may not always consider the securities law implications of their social media use. As a starting point, a public company should be sure that it has a social media policy in place and has trained its employees to know what type of social media activity may be problematic.” For more on what constitutes a strong social media policy, please see the Box below on “Drafting an Effective Social Media Policy.”

Another area of concern that public companies may not always consider, says Gowdy, is the rules concerning the posting of third-party publications on social media. She calls attention to the CSA’s cautionary language around providing links to third-party posts because the links can be perceived as an endorsement. She notes that when a company pays a third party to write a report that is then published on social media, disclosing the details of that relationship is critical.

Striving for Balance

One area the CSA highlighted that some IROs may not have considered was the admonition to provide balanced disclosure on social media – a notoriously positive and upbeat form of media.

“Because of your limited characters, it’s easy on social media to be more focused on buzzwords and tag lines, which sometimes drives you to more of a positive slant on disclosure,” says ARC’s Hjulfors. She points out that the CSA’s staff notice was “a good reminder to make sure we’re taking a balanced approach, and we’re not just tweeting the good news but we’re tweeting all of the news.”

Here’s how Trollope explains the requirement: “It’s important for IROs to always keep in mind that material information must be disclosed in a balanced tone that is not exaggerated or promotional,” she says. “This standard applies whether the information is transmitted via news release or social media.”

Trollope notes “the stakes are high for social media use in investor relations.” For instance, the CSA pointed out that in some cases, poor or selective disclosure over social media resulted in material stock movements, which, she says, “may have led to investor harm.”

Knowing when a positive presentation on social media becomes too glowing – and therefore unbalanced – can be a tough judgment call, according to Gowdy. While she explains that the CSA has said that focusing on positive news on social media is not in itself problematic, the CSA warns that “social media disclosure that is predominantly positive can become cause for concern when, individually or in aggregate, it is sufficiently promotional or unbalanced.” She continues: “It is not always a clear rule to follow and can often depend on the nature of the information that is being disclosed on social media.”

Potential Impact on Social Media Use

In its 2016 NIRI Social Media for Investor Relations Study, the American-based professional association found that the majority – 72% – of IR professionals report that they do not use social media for work. NIRI notes that this figure has remained consistent over the past seven years.

Hjulfors suggests that one reason IROs shy away from social media is that “they’re scared of the approval process.” She believes that the greater clarity provided by the CSA notice might make more Canadian IROs comfortable with venturing onto these new communications outlets.

Gowdy is also convinced that greater clarity might have a positive effect on social media usage by IROs. She notes that 30% of issuers flagged in the CSA study “took action to improve their disclosure based on the results.” She also says the notice has sparked a positive conversation among lawyers and issuers about disclosure on social media.

“Social media can play a key role in a company’s investor relations process, you just need to be mindful of the rules,” says Gowdy. “Social media can definitely access a different cross-section of an investing population that may tend to skew younger and may not access media through traditional means.”

Hansell also concludes that the CSA’s reminder about how to stay on the right side of continuous disclosure rules on social media is valuable. “Social media is fast and it’s casual,” she says, “but that doesn’t change the legal requirements around the disclosure of material information.”