Andy Brown, KPMG

Andy Brown, KPMG Rob Brouwer, KPMG

Rob Brouwer, KPMG

While companies have been diligently focused on the implementation of the new revenue standard that became effective on January 1, 2018, the financial reporting community now needs to turn its attention to the new lease standard. Experience to date has shown that many companies are surprised by some of the implementation challenges that the new lease standard is presenting.

Unlike the revenue standard, which had significant impacts for some companies but minimal or no impact for others, virtually every company will be impacted by the new lease standard. This standard becomes effective in 2019 and will move billions of dollars in operating leases onto Canadian companies’ balance sheets and significantly impact many key performance metrics. Investors and analysts are grappling with the financial impacts of this new standard on the companies they follow, and there will be increasing pressure on investor relations professionals in the months ahead to educate them.

A Time-Consuming Exercise

Many large companies have thousands of operating leases – spread across numerous geographic locations – that are currently ‘off-balance sheet’. It is not surprising that for some, simply identifying these leases is a substantial undertaking. These leases then need to be abstracted, analyzed, entered into a lease accounting system, validated and monitored throughout the lease term as they are accounted for on the company’s balance sheet. Based on a KPMG survey[1] of some 250 companies, most have begun taking significant steps on their lease projects, but their progress remains slow. Companies should consider the lessons learned from their recent implementation of the new revenue standard, and consider discussing that experience with internal and external stakeholders when planning their lease implementation project.

Many companies are discovering that the original estimates of their lease population are not as accurate or as complete as initially thought, particularly when considering other contracts that may contain an embedded lease. Only when a complete inventory of leases has been developed can an accurate projection of the future impact on key performance metrics be determined.

Expected Level of Impact

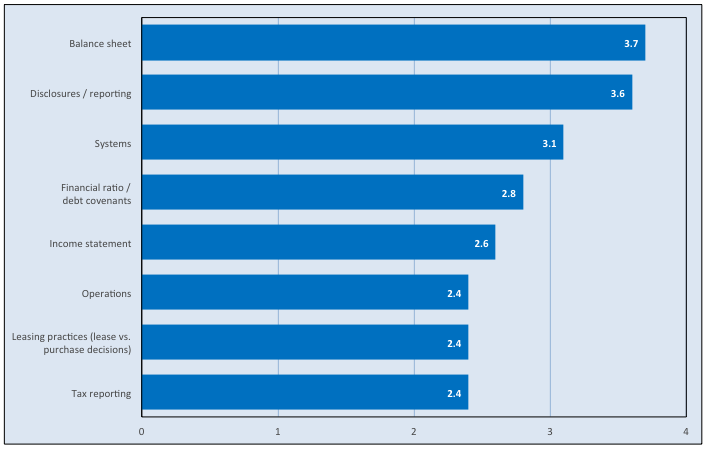

The table below, based on KPMG’s survey, sets out respondents' expectations regarding the level of impact of the new lease standard. As you can see, the impacts are not limited to accounting and financial reporting. Implementation teams will need to involve individuals from operations, IT, investor relations and treasury functions.

1 = no impact at all, 5 = significant impact

1 = no impact at all, 5 = significant impact

A Team Effort

Successful implementation involves more than just the finance function, given how pervasive leases are across a business – from frontline employees signing contracts, to the treasury and tax groups, which will see significant impacts, to the IR professionals explaining those impacts to key stakeholders.

The KPMG survey reveals that most companies have not yet involved all the right key stakeholders – including audit committees, the corporate development group and the investor community (both internal IR and external stakeholders) – in the lease implementation process. IROs need to be involved in this project to ensure they are well informed on the proposed transition method and its financial impacts.

IR professionals need to start educating the investor community and consider status updates via quarterly financial disclosures and analyst calls. Investors are keen to understand how the new rules will affect the company’s assets, liabilities and key performance metrics – it’s time to get prepared for their inevitable questions.

Andy Brown, CPA, CA is a Senior Manager, and Rob Brouwer, FCPA, CPA is Canadian Managing Partner, Clients and Markets, for KPMG LLP in Canada.