David Warren, KPMG

David Warren, KPMG

Rob Brouwer, KPMG

Rob Brouwer, KPMG

After long debate about this complex area, the release of the new financial instruments standard IFRS 9 last month substantially completes a project launched in 2008 in response to the financial crisis.

The new standard includes revised guidance on the classification and measurement of financial assets, as well as a new expected credit loss model for calculating impairment, and supplements the new general hedge accounting requirements published in 2013.

While the standard is not effective until 2018, implementation efforts for IFRS 9 should begin in earnest now, as a number of differences exist compared with the current IAS 39 standard.

Classification and measurement

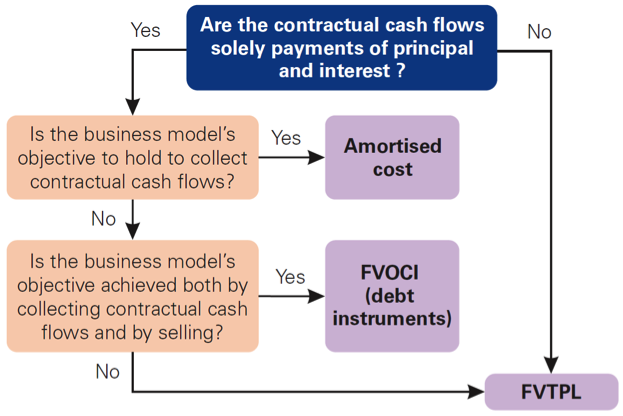

Although the permissible measurement bases for financial assets – i) amortized cost, ii) fair value through other comprehensive income (FVOCI), and iii) fair value through profit and loss (FVTPL) – are similar to IAS 39, the criteria for classifying instruments in those categories are significantly different:

- Embedded derivatives – such as prepayment features not closely related to the debt host – are no longer separated from financial asset hosts; instead, the entire hybrid instrument is assessed for classification as per the diagram below.

- For an equity instrument that is not held for trading – such as an investment in a private company – an entity may elect to irrevocably present subsequent changes in fair value in OCI. These are not reclassified to profit or loss under any circumstances to ensure gains and losses are only recognized once.

- If classifying a financial asset at amortized cost or at FVOCI would create an accounting mismatch, a company can make an irrevocable choice to classify it at FVTPL if that would reduce the mismatch. IFRS 9 provides an example where an entity has financed a specified group of loans by issuing traded bonds whose changes in fair value tend to offset each other. If the entity regularly buys and sells the bonds, but rarely buys and sells the loans, reporting both the loans and the bonds at fair value through profit or loss eliminates the inconsistency in the timing of the recognition of the gains and losses that would otherwise result from measuring them both at amortized cost and recognizing a gain or loss each time a bond is repurchased.

- For debt instruments measured at FVOCI, interest revenue, expected credit losses and foreign exchange gains and losses are recognized in profit or loss in the same manner as for amortized cost assets. Other gains and losses are recognized in OCI and are reclassified to profit or loss on sale or settlement.

For the classification and measurement of financial liabilities, IFRS 9 retains almost all of the existing requirements from IAS 39. However, the gain or loss on a financial liability designated at FVTPL that is attributable to changes in its credit risk is usually presented in OCI.

Impairment

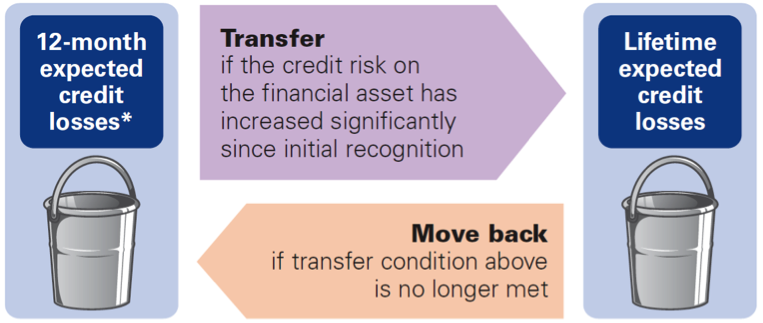

IFRS 9 replaces the ‘incurred loss’ model in IAS 39 with an ‘expected credit loss’ model, which means that a ‘loss event’ will no longer need to occur before an impairment allowance is required to be recognized. The new standard aims to address concerns about ‘too little, too late’ provisioning for loan losses, and will accelerate recognition of credit losses.

Estimating impairment is an art rather than a science. It involves difficult judgments about whether loans will be paid as due – and, if not, how much will be recovered and when. The new model – which widens the scope of these judgments – relies on companies being able to make robust estimates of:

- expected credit losses; and

- the point at which there is a significant increase in credit risk.

In general, the expected credit loss model uses a dual measurement approach.

* 12-month expected credit losses are defined as the expected credit losses that result from those default events on the financial instrument that are possible within the 12 months after the reporting date.

If the credit risk of a financial asset has not increased significantly since its initial recognition, the loss allowance is equal to credit losses that result from default events that are possible within the 12 months after the reporting date. If its credit risk has increased significantly, the allowance is equal to expected credit losses that result from all possible default events over the life of the instrument.

The new model will apply to financial assets that are:

- debt instruments recognized on-balance sheet, such as loans or bonds;

- classified as measured at amortized cost or at FVOCI; and

- certain loan commitments and financial guarantees.

If you find the new model presents significant complexity, you are not alone. To address the operational challenges of applying the two bucket model to non-financial institutions, the IASB introduced a simplified approach, which is available to be used for certain trade and lease receivables and for contract assets, where the allowance is always equal to lifetime expected losses.

Start looking at your financial instruments now

All companies will need to assess the extent of the impacts so they can address the wider business implications, including communications with investors and analysts. While the January 1, 2018, effective date may seem a long way off, some decisions will need to be made soon.

Applying the classification and measurement criteria will require companies to implement new processes to ensure allocation of financial assets to the appropriate measurement category.

The new impairment model is likely to have the most significant impact on the systems and processes of banks, insurers and other financial services companies. All companies with trade receivables will be affected; however, the impact is likely to be smaller and certain simplifications are available.

Preparing for the far-reaching impacts of these changes may take considerable effort. Companies – especially in the financial sector – need to start assessing the possible impacts now and begin planning for transition, to understand the time, resources and changes to systems and processes that are needed. IR professionals are well advised to get ahead of the issue, if it is expected to have a significant impact on your industry.

Dave Warren, CA is a Senior Manager, and Rob Brouwer, FCA is Canadian Managing Partner, Clients and Markets, for KPMG LLP in Canada.