Andy Brown, KPMG

Andy Brown, KPMG Rob Brouwer, KPMG

Rob Brouwer, KPMG

In our last column, we explored an overview of the new international leases standard, IFRS 16, issued by the International Accounting Standards Board (IASB) earlier this year and effective for calendar year companies in 2019. This standard fundamentally changes lease accounting, requiring lessees to bring previously unrecognized operating leases on-balance sheet. A recent survey of the Canadian business community conducted by KPMG found that 69% of respondents believe the new standard will have a moderate to significant impact on their organization. In this column, we take a closer look at the impact the standard will have on KPIs for companies that currently lease assets through operating leases (“lessees”).

Impact on primary statements

On the balance sheet, lessees will recognize a new asset representing the right to use the underlying leased asset, and a new liability, the obligation to make lease payments. Essentially, a lease will be accounted for as if the company had borrowed funds to purchase a portion of the asset under lease. Companies will recognize both depreciation expense on the leased asset and interest expense on the related liability.

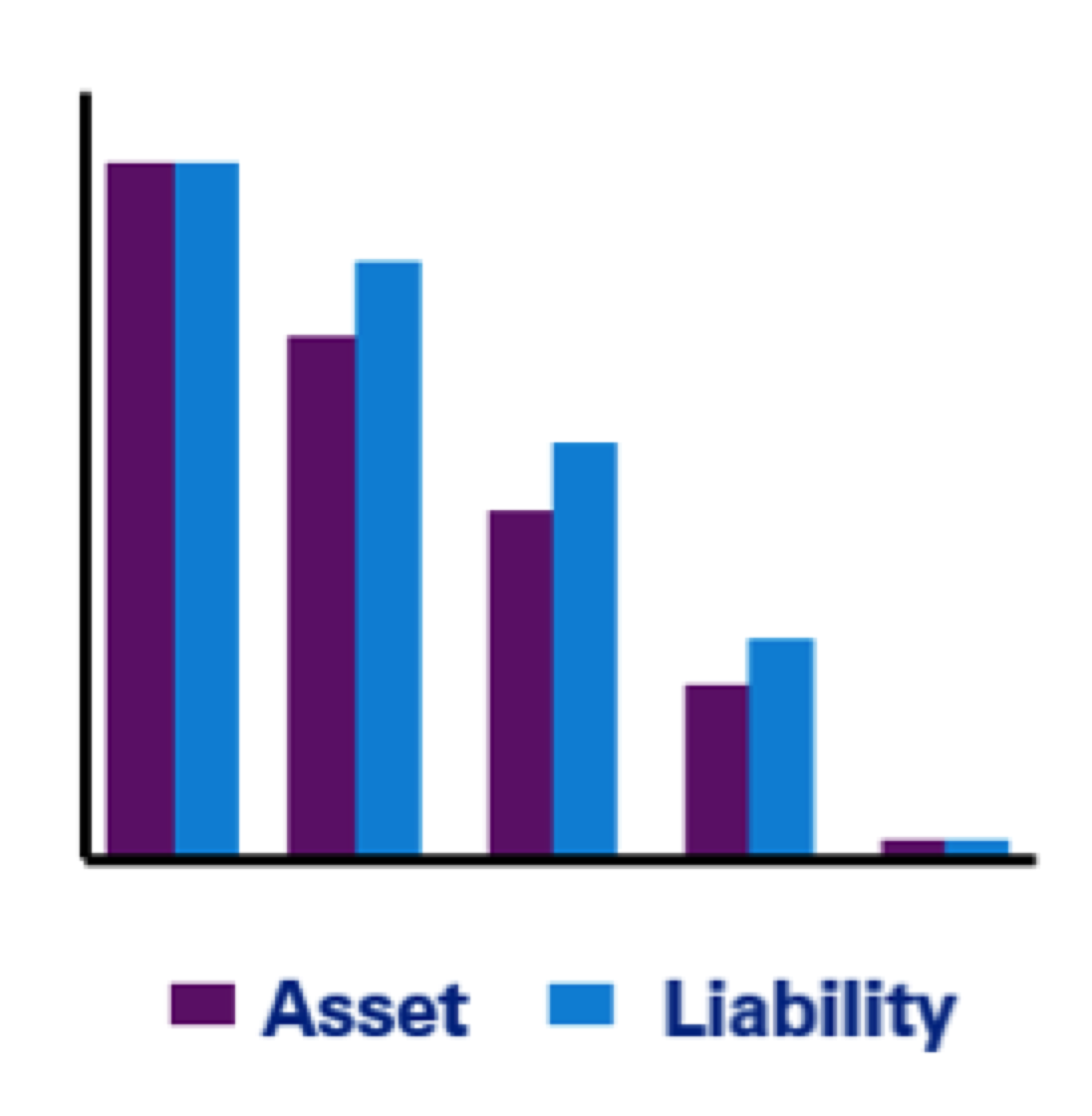

Let’s consider the impacts on a single lease with a five-year term. With no prepaid rent or initial direct costs, the leased asset and liability are equal on day one. Over the course of the lease term, the carrying amounts of the asset and liability decrease as the asset is depreciated and the liability is repaid. It is important to note the carrying amount of the asset decreases more quickly than the carrying amount of the liability. As shown in the diagram below, the lease represents a net liability on the balance sheet from day two onward.

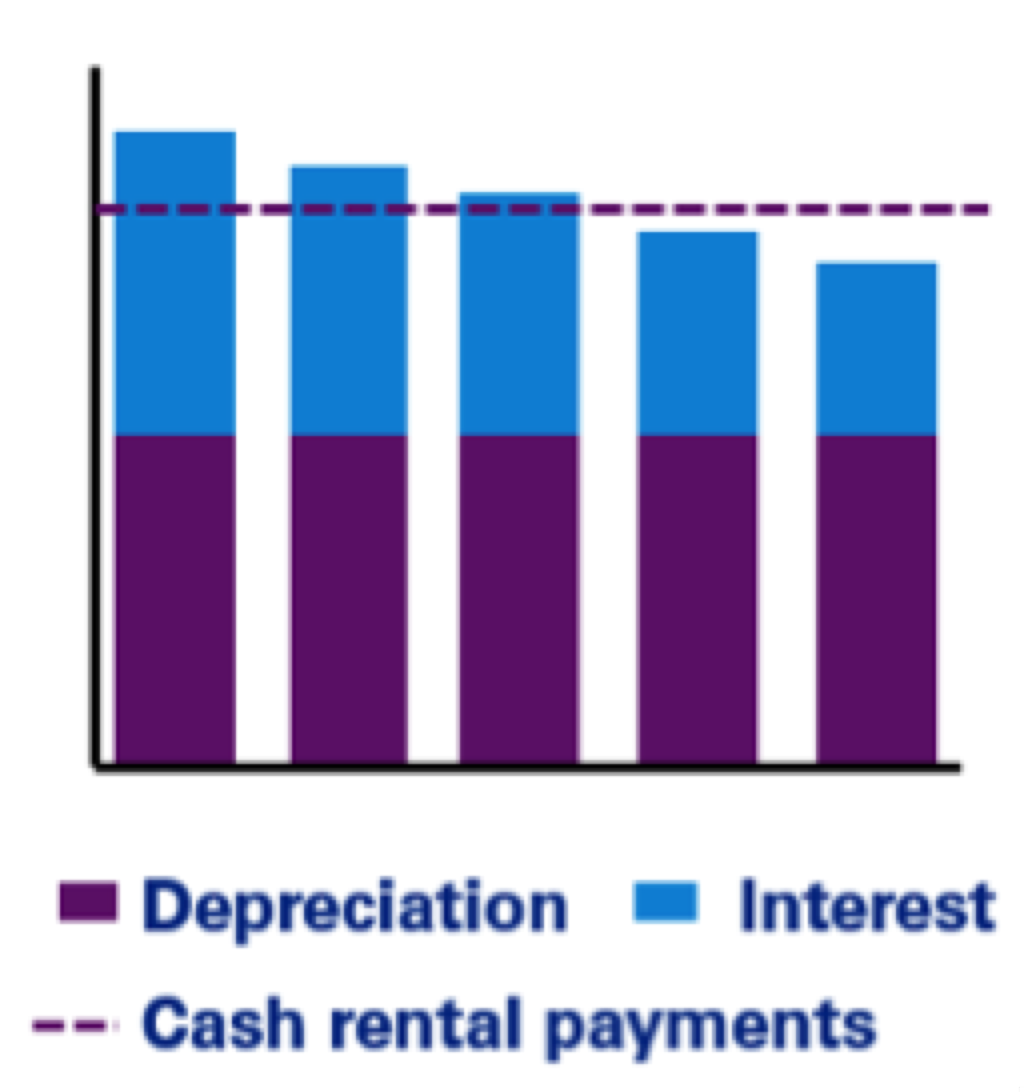

These balance sheet changes have a ripple effect on the P&L – changing both the amount of expense to be recognized each period and the geography of where the expense is recognized on the P&L. Depreciation of the leased asset is typically straight-line over the lease term. Interest expense on the lease liability will be determined using the effective interest rate method and will decrease year-over-year. Even with equal periodic cash rental payments, total expense (depreciation plus interest) at the beginning of the lease is more than the cash rent paid, and decreases over the lease term. Essentially, the expense is being front-loaded over the lease term. This relationship is why this accounting model results in a net liability on the balance sheet.

With a new lease liability akin to financing an asset purchase, when a payment is made against this liability it is shown as a financing activity on the statement of cash flows. Compare this to current operating lease payments, which are recorded in operating activities. For lessees, this reclassification will have the effect of improving reported cash flows from operations.

Impact on KPIs

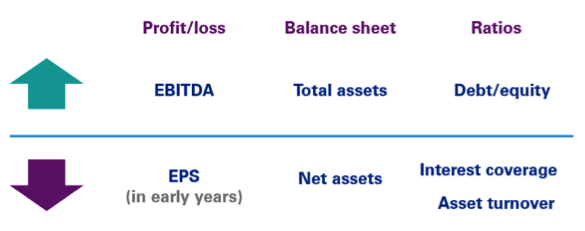

These impacts on the primary statements will inevitably affect KPIs – some favourably and others unfavourably. As noted, total lease expense under the new standard is front-loaded, compared with current operating lease accounting, which is straight-line over the lease term. This will lead to lower earnings in the early years of a lease and lower earnings per share. The front-loaded pattern of total lease expense, however, may average out across a portfolio of leases in a large, stable business. Furthermore, while lease expense will be front-loaded at the inception of any individual lease, on the adoption of the new standard the average maturity of a company’s lease portfolio will of course dictate whether this will increase or decrease compared to today’s lease expense. However, the front-loading effect could be significant in aggregate for a growing business, or a business that is undertaking a major refresh of its portfolio of leased assets – for example, an airline that is introducing a new model of aircraft across its fleet.

While the recognition pattern of lease expense will negatively impact reported earnings nearer the beginning of a particular lease, the geography of lease expense will have a positive impact on EBITDA, a KPI used by many to measure performance. This is because lease expense is moving out of operating costs and will now be reflected as a combination of interest expense and depreciation expense. IFRS 16 effectively removes lease costs entirely from the calculation of EBITDA for lessees.

Total assets will grow with the recognition of the leased asset, however net assets will decrease as the depreciation of the asset will outpace the reduction of the lease liability.

As it relates to some commonly used ratios, those based on EBITDA will be positively impacted by the change to that measure. Unfortunately, ratios based on debt or interest will be negatively impacted by the increase in reported debt on the balance sheet and interest expense on the P&L.

These KPIs form the basis of many companies’ internal and external reporting. Significant changes to these metrics will undoubtedly result in users of these measures asking questions and seeking clarification to understand the new standard’s impact.

Comparison to U.S. GAAP

Further complicating comparisons between companies and their competitors is the new U.S. GAAP leases standard (ASC Topic 842), also released this year.

The Financial Accounting Standards Board (FASB) and IASB started the leasing project together and some of the high level, broad concepts, like the definition of a lease and the fact that leases will now be on-balance sheet, have been converged. However, there are some significant divergences in the application of those broad concepts. The most important difference impacting KPIs is in the concept of lease classification that has been retained under the FASB’s model for P&L recognition. U.S. GAAP retained the pre-existing concept of an operating and capital lease and the P&L and cash flow recognition that accompanied those classifications.

Essentially, the P&L and statement of cash flows are substantially unchanged under U.S. GAAP, despite having operating leases recognized on-balance sheet. Thinking about the KPIs discussed above, companies reporting under U.S. GAAP will be impacted much differently than those reporting under IFRS. While IFRS 16 will have a positive impact on a company’s EBITDA, U.S. GAAP is not changing the geography of reported lease expense leaving EBITDA unchanged. Further, the U.S. standard will not significantly impact the presentation of leases on the statement of cash flows.

With so many Canadian companies having competitors reporting under U.S. GAAP, it is important to understand that comparability needs to be understood and explained, and will be more difficult once these new standards have been implemented. The issue of comparability may also have impacts outside the financial statements. Companies reporting adjusted non-GAAP measures in their public disclosures should consider how the new standard will impact these measures and the comparability with competitors under IFRS or U.S. GAAP.

So where to go from here? If a lot of the impacts outlined in this article are news to you, you are not alone. In a recent KPMG poll of over 600 accounting professionals, 50% of respondents are only at the beginning stages of assessing the impact of the new standard. Investor relations professionals are well advised to keep connected with their finance teams to understand how the adoption of the new standard will impact the organization’s KPIs and its comparability with its competitors in order to ensure early communication of anticipated changes to the market.

Andy Brown, CPA, CA is a Senior Manager, and Rob Brouwer, FCPA, CPA is Canadian Managing Partner, Clients and Markets, for KPMG LLP in Canada.