David Warren, KPMG

David Warren, KPMG

Rob Brouwer, KPMG

Rob Brouwer, KPMG

A new standard issued this past May replaces existing IFRS and U.S. GAAP guidance, and introduces a new model for revenue recognition. The new standard is effective for annual periods beginning on or after January 1, 2017.

For some, this new standard will significantly impact how and when you will recognize and account for revenue.

If your company has operations in telecommunications, software, real estate, aerospace and defense, building and construction, or contract manufacturing, you are more likely to be significantly affected by one or more of the new requirements.

The new standard:

- retains the ‘risk and rewards’ concept as an indicator of when control over the goods or services sold is transferred;

- requires that consideration be measured as the amount to which the company expects to be entitled (rather than fair value);

- provides guidance on separating goods and services in a contract; and

- provides guidance on recognizing revenue over time.

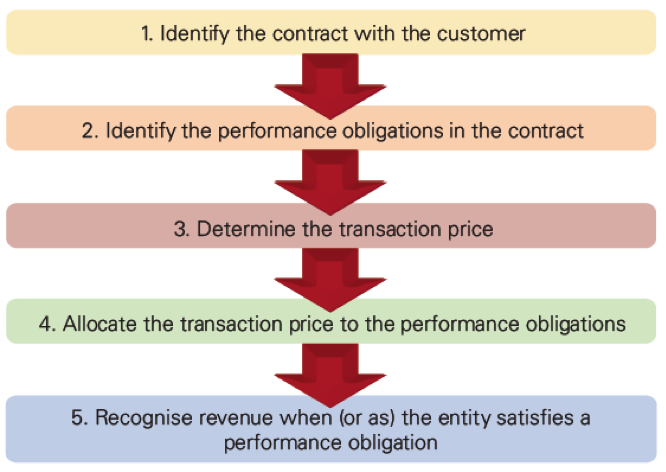

One model, two approaches, five steps

The standard contains a single model that applies to contracts with customers and two approaches to recognizing revenue – at a single point in time or over a period of time. The model provides a five-step analysis of transactions to determine whether, how much and when revenue is recognized.

Under the new standard, there are circumstances where revenue is recognized over time, in a manner that best reflects the company’s performance, or there are circumstances where revenue is recognized at a point in time when control of the good or service is transferred to the customer.

For complex transactions with multiple components and/or variable amounts of consideration, or when the work is carried out under contract for an extended period, applying the standard may lead to revenue being accelerated or deferred in comparison with current practice. The standard provides guidance on estimates and judgments relative to:

- estimating and recognizing variable consideration; and

- identifying separate goods and services in a contract.

While the standard has retained stage of completion accounting, it includes new criteria to determine when it is to be used, and how revenues should be recognized over time. Applying the new criteria means that some construction contracts and contracts for services that are currently accounted for under the stage of completion method may now require revenue to be recognized on contract completion; but for other contracts, the stage of completion method may be applied for the first time.

New disclosure requirements

The new standard also includes extensive new disclosure requirements. You may have to redesign, and in many cases significantly expand, the information captured about unfulfilled performance obligations in order to draft the notes to the financial statements dealing with revenue.

While the new disclosures are designed to convey important information to investors, it of course becomes available to competitors also and in some cases that may be sensitive. No exemptions have, however, been provided for commercial sensitive information.

Transition options

The standard may be adopted retrospectively with restatement, or as of the application date, by adjusting retained earnings at the application date and disclosing the effect of adoption on each line of the income statement. Given the high degree of complexity that the new standard will drive for some companies, practical expedients are available to those taking a retrospective approach.

Start looking at your contracts now…

All companies will need to assess the extent of the impacts so they can address the wider business implications, including communications with investors and analysts. While the January 1, 2017 effective date may seem a long way off, some decisions will need to be made soon.

Historical analysis or retrospective application may require you to introduce new systems and processes well in advance of the new standard’s effective date, and to run them in parallel with those already in place.

The estimates, thresholds and disclosure requirements may lead to changes in systems and processes to capture and review the required data. Investors, analysts and other stakeholders may also soon want to understand the impact of the new standard on your business.

As you prepare, you may want to also consider whether:

- debt covenant and other financial ratios may be affected;

- changes to the timing of revenue recognition may affect the timing of tax payments; and

- staff bonuses and incentive plans might also need to be reconsidered.

The implications of the new revenue recognition standard for some companies may be significant enough to lead to a fundamental reassessment of the contract terms offered to customers and the business practices used, in order to achieve or maintain a particular revenue profile. IR professionals are well advised to get ahead of the issue, if it is expected to have a significant impact on your industry.

Dave Warren, CA is a Senior Manager, and Rob Brouwer, FCA is Canadian Managing Partner, Clients and Markets, for KPMG LLP in Canada.